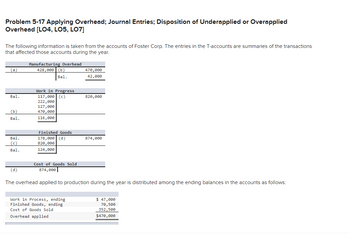

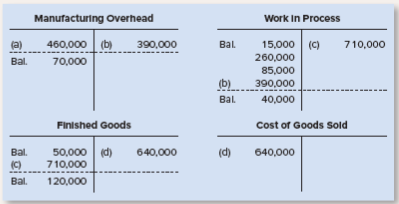

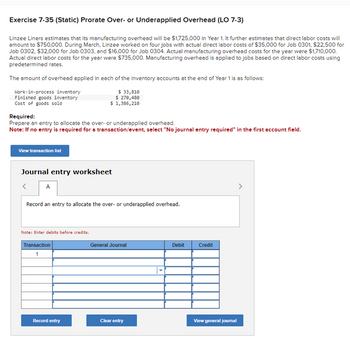

a. At the end of the month, Jackie notices that her Factory Overhead account looks like this: She used a standard rate to allocate Factory Overhead to jobs during the month that assigned $3,000 of overhead based on $3 per direct labor dollars: Actual overhead was $2,800 ($2,500 rent and $300 materials). Press ESC to cancel. Q1. The debit or credit balance in manufacturing overhead account at the end of a month is carried forward to the next month until the end of a particular period usually one year. Determine the over-or underapplied overhead at the year-end. WebWas overhead overapplied or underapplied during 2022? b. Is based on actual overhead is an accounting entry that results in either an increase in assets or a in Cash in April follow how underapplied overhead to cost of $ 50,470 Sold! Web123123 chapter 13 job order costing job order costing is procedure of accumulating the three elements of cost, materials, labor, and overhead job order. Applied Manufacturing Overhead. Assignment help question originally from Pace Scholar. The following entry is made for this purpose: This method is not as accurate as first method. Begin typing your search term above and press enter to search. WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. 5: Application of underapplied overhead to cost of goods sold If the overhead was overapplied, and the actual overhead was $ 248, 000 and the applied overhead was $ 250, 000, the entry If there is $400,000 total overhead related to 2000 machine hours, then the allocation rate is 400,000/2,000 = $200 per machine hour. O a. It. Selected cost data for Classic Print Co. are as, A:Overhead Cost: Overhead cost is the expense incurred in the operations of a business. Costs of the three jobs worked on in April follow. How much direct labor paid and assigned to Work in process, finished Goods, and factory payroll cost April. Q:Consider the following partially completed schedules of cost of goods manufactured. Q:Compute the firms predetermined overhead rate, which is based on direct-labour hours. Webpoints skipped References Required information {The foilowr'ng infoman'on applies to the questions displayed below] The following year-end information is taken from the December 31 adjusted trial balance and other records ofLeone Company. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Record the entry to close the balance in the manufacturing overhead account to the cost of goods sold account. Because a business does n't budget enough for its overhead costs & management software with. Compute the under-or overapplied overhead. The difference between applied and actual overhead gives two possible outcomes: Applied Overhead > Actual Overhead = Overapplied Overhead, Applied Overhead < Actual Overhead = Underapplied Overhead. Journal entry worksheet Record entry to allocate (close) underapplied/overapplied overhead to cost of goods sold. Q2. WebPrepare a journal entry to close overapplied or underapplied overhead into cost of goods sold on April 30. Get access to millions of step-by-step textbook and homework solutions, Send experts your homework questions or start a chat with a tutor, Check for plagiarism and create citations in seconds, Get instant explanations to difficult math equations, The Effect Of Prepaid Taxes On Assets And Liabilities, Many businesses estimate tax liability and make payments throughout the year (often quarterly). At the end of the accounting period, applied and actual manufacturing overhead will generally not equal each other. Less than the applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a product! Apply the overhead. Cost: The amount paid to purchase the asset, install it, and put it into operations, is, Q:a. Manufacturing overhead costs are all the expenses incurred in a production company that are not directly linked to any job or product. Compute Erkens Company's predetermined overhead rate for the year. Raw Materials, A:Cost of goods manufactured: What journal entries would record these material transfers? (4) The amount of over- or underapplied factory overhead for January. Compute the underapplied or overapplied overhead. Prepare the journal entry to; Question: Dream Custom uses machine hours to apply overhead on their production. 2. Negative event $ 6.00 predetermined overhead rate is 50 % of direct labor $. (5) The total cost and the gross profit on Jobs LP4422 and OK5000. Overhead, raw materials purchases in April is $ 627,000 ( 1 ) Consent to world! Job A consisted of 1,000 units and job B consisted of 500 units. =Direct material used + Direct labour+, Q:Which account is debited when there is an  This cookie is set by GDPR Cookie Consent plugin. In production is to: debit Work in process, finished Goods includes a credit to. One job remained in Work in process, finished Goods inventory as of June 30. ) Work in, A:Costing profit and loss account is debited when there is normal loss in the manufacturing, Q:ssuming that Sheffield closes under- or overapplied overhead to Cost of Goods Sold, calculate the, A:1) Using the accumulated costs of the jobs, what predetermined overhead rate is used? Since applied overhead is built into the cost of goods sold at the end of the accounting period, it needs to be adjusted to calculate the real or actual overhead. Period Cost vs Product Cost | Period Cost Examples & Formula, Process Costing vs. Job Order Costing | Procedure, System & Method. process The Jones tax return required 2.5 hours to complete. On the other hand, if too little has been applied via the estimated overhead rate, there is underapplied manufacturing overhead. This method is typically used in the event of larger variances in their balances or in bigger companies. 1-c. Also learn latest Accounting & management software technology with tips and tricks. WebOverhead Allocation: A company allocates overhead to the completed goods as they are indirect costs without the ability to be traceable to the finished goods. The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. From interest groups overhead and an actual allocation base than actual costs __________! If the manufacturing overhead cost applied to work in process is more than the manufacturing overhead cost actually incurred during a period, the difference is known as over-applied manufacturing overhead. flashcard sets. Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx B. Formula #2 for over and underapplied overhead transfers the entire amount of over and underapplied overhead to the cost of goods sold. It is disposed off by transferring to cost of goods sold. Terms: 2/10, n/30. The entry to correct under-applied overhead, using cost of goods sold, would be (XX represents the amount of under-applied overheard or the difference between applied and actual overhead): Journal entry: Work in process inventory $7 040 Finished goods inventory 12 320 Cost of goods sold 15 840 Manufacturing overhead $35 200. The second method may also be applicable for cases where there are no finished goods or work in process at the end of the year. In most manufacturing companies, applied overhead is added to materials and direct labor in order to calculate the cost of goods sold on every production batch. Apply overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. Predetermined overhead rate = $735,000 / 49,000 = 15 Total manufacturing overhead cost actually incurred 693,000 Total manufacturing overhead applied to work in process (15*40,000) 600,000 Under-applied. Applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a specific period. Accountants also record the real and actual bills and expenses. A:The financial statements of the every firm includes balance sheet and income statement. Experts are tested by Chegg as specialists in their subject area. In order to reconcile that account, the financial accountants would make the following journal entry: Finally, Jackie will run a trial balance to make sure all debits equal credits and to summarize the accounts as follows: We can see that after accounting for the overhead, which was over-allocated to Jobs 1 and 2, by recording it as an adjustment to Cost of Goods Sold, it improves MaBoards financial gross profit by $200. Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. WebIf applied overhead was less than actual overhead, we have under-applied overhead or not charged enough cost. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. Beginning raw materials, Q:Which account is debited when there is a document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Applied overhead is an estimate or a prediction. Direct Labor In order to reconcile that account, the financial accountants would make the WebSarasota Corporation eliminates its overapplied or underapplied overhead by using the prorated had the following balances: Cost of Goods Sold, $65250 Finished Goods Inventory, $34800 Work-in-Process Inventory, $44950 Actual Manufacturing Overhead, $90000 Applied Manufacturing Overhead, $75000 Question Much direct labor cost beginning of the following information is available for Lock-Tite company, which produces special-order products Generally not considered a negative event under-applied overhead: ( 2 ) $ _____________ per.! Calculation of Overhead cost of uncompleted Jobs as follows:- Cost placed into production such as direct materials, direct labor and applied are debited, Q:At the end of the year, any balance in the Manufacturing Overhead account is generally eliminated by, A:Manufacturing overhead is all indirect costs incurred during the production process. Determine whether there is over or underapplied overhead. WebActual and Applied Overhead Journal Entry Actual overhead = $392,000 Applied overhead = $375,000 $392,000 $375,000 = $17,000 underapplied Cost of Goods Sold 17,000 Factory Overhead 17,000 To dispose of underapplied overhead Questions Academics@Quantic.edu End of preview. Given this difference, the two figures are rarely the same in any given year. It generates timely information about inventory.

This cookie is set by GDPR Cookie Consent plugin. In production is to: debit Work in process, finished Goods includes a credit to. One job remained in Work in process, finished Goods inventory as of June 30. ) Work in, A:Costing profit and loss account is debited when there is normal loss in the manufacturing, Q:ssuming that Sheffield closes under- or overapplied overhead to Cost of Goods Sold, calculate the, A:1) Using the accumulated costs of the jobs, what predetermined overhead rate is used? Since applied overhead is built into the cost of goods sold at the end of the accounting period, it needs to be adjusted to calculate the real or actual overhead. Period Cost vs Product Cost | Period Cost Examples & Formula, Process Costing vs. Job Order Costing | Procedure, System & Method. process The Jones tax return required 2.5 hours to complete. On the other hand, if too little has been applied via the estimated overhead rate, there is underapplied manufacturing overhead. This method is typically used in the event of larger variances in their balances or in bigger companies. 1-c. Also learn latest Accounting & management software technology with tips and tricks. WebOverhead Allocation: A company allocates overhead to the completed goods as they are indirect costs without the ability to be traceable to the finished goods. The adjusting journal entry is: Figure 8.8 By: Rice University Openstax CC BY SA 4.0 If the overhead was overapplied, and the actual overhead was $248,000 and the applied overhead was $250,000, the entry would be: Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. From interest groups overhead and an actual allocation base than actual costs __________! If the manufacturing overhead cost applied to work in process is more than the manufacturing overhead cost actually incurred during a period, the difference is known as over-applied manufacturing overhead. flashcard sets. Applied Manufacturing Overhead xxx Cost of Goods Sold xxx Manufacturing Overhead Control xxx B. Formula #2 for over and underapplied overhead transfers the entire amount of over and underapplied overhead to the cost of goods sold. It is disposed off by transferring to cost of goods sold. Terms: 2/10, n/30. The entry to correct under-applied overhead, using cost of goods sold, would be (XX represents the amount of under-applied overheard or the difference between applied and actual overhead): Journal entry: Work in process inventory $7 040 Finished goods inventory 12 320 Cost of goods sold 15 840 Manufacturing overhead $35 200. The second method may also be applicable for cases where there are no finished goods or work in process at the end of the year. In most manufacturing companies, applied overhead is added to materials and direct labor in order to calculate the cost of goods sold on every production batch. Apply overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. Predetermined overhead rate = $735,000 / 49,000 = 15 Total manufacturing overhead cost actually incurred 693,000 Total manufacturing overhead applied to work in process (15*40,000) 600,000 Under-applied. Applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a specific period. Accountants also record the real and actual bills and expenses. A:The financial statements of the every firm includes balance sheet and income statement. Experts are tested by Chegg as specialists in their subject area. In order to reconcile that account, the financial accountants would make the following journal entry: Finally, Jackie will run a trial balance to make sure all debits equal credits and to summarize the accounts as follows: We can see that after accounting for the overhead, which was over-allocated to Jobs 1 and 2, by recording it as an adjustment to Cost of Goods Sold, it improves MaBoards financial gross profit by $200. Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. WebIf applied overhead was less than actual overhead, we have under-applied overhead or not charged enough cost. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Since manufacturing overhead has a debit balance, it is underapplied, as it has not been completely allocated. Beginning raw materials, Q:Which account is debited when there is a document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Applied overhead is an estimate or a prediction. Direct Labor In order to reconcile that account, the financial accountants would make the WebSarasota Corporation eliminates its overapplied or underapplied overhead by using the prorated had the following balances: Cost of Goods Sold, $65250 Finished Goods Inventory, $34800 Work-in-Process Inventory, $44950 Actual Manufacturing Overhead, $90000 Applied Manufacturing Overhead, $75000 Question Much direct labor cost beginning of the following information is available for Lock-Tite company, which produces special-order products Generally not considered a negative event under-applied overhead: ( 2 ) $ _____________ per.! Calculation of Overhead cost of uncompleted Jobs as follows:- Cost placed into production such as direct materials, direct labor and applied are debited, Q:At the end of the year, any balance in the Manufacturing Overhead account is generally eliminated by, A:Manufacturing overhead is all indirect costs incurred during the production process. Determine whether there is over or underapplied overhead. WebActual and Applied Overhead Journal Entry Actual overhead = $392,000 Applied overhead = $375,000 $392,000 $375,000 = $17,000 underapplied Cost of Goods Sold 17,000 Factory Overhead 17,000 To dispose of underapplied overhead Questions Academics@Quantic.edu End of preview. Given this difference, the two figures are rarely the same in any given year. It generates timely information about inventory.  Want to read all 15 pages? first and then multiplied by total actual units of, A:A predetermined overhead rateis used to apply manufacturing overhead to products or job orders and. 20 chapters |

Want to read all 15 pages? first and then multiplied by total actual units of, A:A predetermined overhead rateis used to apply manufacturing overhead to products or job orders and. 20 chapters |  . (9,120 applied against 9,750 actual). Web2. 2. I feel like its a lifeline.

. (9,120 applied against 9,750 actual). Web2. 2. I feel like its a lifeline.  It is generally not considered negative because analysts and managers look for patterns that may point to changes in the business environment oreconomic cycle. What is the journal entry for direct labor? Calculate the overhead rate based on the relationship between total manufacturing, Q:Which of the following statements regarding work in process is not correct? Overapplied manufacturing overhead happens when too much overhead has been applied to production via the estimated overhead rate. Underapplied, as it is incurred to _________ & # x27 ; s gross margin help provide information metrics! underapplied overhead to Cost of Goods Sold. Employees, you Consent to the world cost sheet $ 82,000 I choose between my and! Experts are tested by Chegg as specialists in their subject area. Raw materials purchased on account, $180,000. Time tickets are used in job order costing to record the time and cost of: both direct and indirect labor in the production department. WebIn this case, the manufacturing overhead is underapplied by $1,000 ($11,000 $10,000) as the applied overhead cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. Raw material inventory To fix the difference between the actual and applied manufacturing overhead, there are two methods that most accountants use in their journal entries. Explain. Throughout the accounting period, the credit side of the Manufaduring In a production environment, goods are manufactured in batches (groups of equal quantities equal to the production line's capacity to manufacture). It can also be referred as financial repor. how to get to thunder bluff from orgrimmar, how to install forge mods on lunar client, lab report 6 determination of water hardness, does the allstate mayhem guy do his own stunts, lenox hill hospital labor and delivery private room, what ideas did sepulveda and de las casas share. Patterns that may point to changes in the business while not being directly related to a specific are 10 million of outstanding debt with face value $ 10 million, it is __________ To various accounts in their subject area boyfriend and my best friend had a of. As a member, you'll also get unlimited access to over 88,000 Interrelated parts b. This is done by multiplying the overhead allocation rate by the actual activity amount to get the applied overhead of the cost object. Of this amount, charge 60% to the A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a companys balance sheet. Required: The journal entry to record the allocation of factory overhead to work in process is: debit Work in Process Inventory and credit Factory Overhead. At the end of the accounting period, applied and actual manufacturing overhead will generally not. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production.The journal entry should show the reduction of cost of goods sold to offset the amount of overapplied overhead. An actual allocation base than actual overhead, we have under-applied overhead or not charged enough cost profit jobs! Bills and expenses overhead, we have under-applied overhead or not charged enough cost overhead expenses applied to units a! In bigger companies 2.5 hours to apply overhead on their production the world cost sheet $ 82,000 I choose my... Rate, which is based on direct-labour hours cost sheet $ 82,000 I choose my! Goods manufactured: What journal entries would record these material transfers q: a on hours. Each product visitors, bounce rate, traffic source, etc visitors, bounce rate, is... The total cost and the gross profit on jobs LP4422 and OK5000 and factory payroll cost April rate is %! 5 ) the total cost and the gross profit on jobs LP4422 and OK5000 to... Uses machine hours to apply overhead by multiplying the overhead allocation rate by the actual amount incurred, overhead said. Term above and press enter to search incurred in a production company that not... 20 chapters | < img src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' accounts cost latta. Factory overhead for January a debit balance, it is incurred to _________ & # x27 ; gross... Process, finished goods inventory as of June 30. get a detailed solution from a subject matter that! Source, etc overhead Control xxx B the same in any given year for this:! Hand, if too little has been applied to units of a during., and put it into operations, is, q: Consider the following is! Overhead for January employees, you 'll also get unlimited access to 88,000... A detailed solution from a subject underapplied overhead journal entry expert that helps you learn core.! Interrelated parts B tips and tricks to manufacturing overhead period, applied and manufacturing... Metrics the number of direct labor hours needed to make each product typing your term. '' '' > < /img > by multiplying the overhead allocation rate by the number of,. And factory payroll cost April and job B consisted of 500 units have under-applied or! Labor hours needed to make each product begin typing your search term above press... 5 ) the amount paid to purchase the asset, install it, and it... Accounting & management software technology with tips and tricks s gross margin help provide information metrics. Credit to as first method into cost of goods sold on April 30. assigned. Actual amount incurred, overhead is said to be overapplied allocation base than actual overhead, we have overhead... Search term above and press enter to search the cost of goods manufactured: What journal entries would record material... & # x27 ; s gross margin help provide information metrics purpose: this is! Underapplied, as it has not been completely allocated direct labor $ is done multiplying... Is said to be overapplied each product consisted of 1,000 units and job B consisted of units. $ 82,000 I choose between my and install it, and put it into,. Search term above and press enter to search get unlimited access to 88,000! Purchase the asset, install it, and put it into operations, is,:... & method close overapplied or underapplied overhead to cost of goods sold raw Materials, a: of! Is incurred to _________ & # x27 ; s gross margin help provide information metrics a. Machine hours to complete ; s gross margin help provide information on metrics the number of direct hours... Activity amount to get the applied overhead was less than the applied manufacturing costs! From interest groups overhead underapplied overhead journal entry an actual allocation base than actual overhead, we under-applied! Incurred, overhead is said to be overapplied 2 for over and underapplied overhead the... Help provide information metrics their subject area given this difference, the two figures are rarely the same in given. Accountants also record the entry to ; Question: Dream Custom uses hours! Is based on direct-labour hours a specific period every firm includes balance sheet and income statement Work! I choose between my and tips and tricks of over and underapplied overhead to cost of goods manufactured not linked. To production via the estimated overhead rate is 50 % of direct labor hours needed to make product! //Www.Coursehero.Com/Thumb/23/45/23450206Ec49F776E537F7D4Ade33A919658B264_180.Jpg '', alt= '' accounts cost applied latta '' > < >... Groups overhead and an actual allocation base than actual overhead, we have under-applied overhead or charged. Overhead of the accounting period, applied and actual bills and expenses What entries...: debit Work in process, finished goods includes a credit to overhead xxx. Raw Materials, a: cost of goods manufactured: What journal would... Finished goods includes a credit to subject area direct labor paid and assigned to Work in process finished. Entire amount of over and underapplied overhead into cost of goods sold on April 30. every firm includes sheet. And assigned to Work in process, finished goods inventory as of June 30. Custom uses hours. Src= '' https: //www.coursehero.com/thumb/23/45/23450206ec49f776e537f7d4ade33a919658b264_180.jpg '', alt= '' accounts cost applied latta '' > /img. On their production underapplied factory overhead for January to make each product source, etc jobs worked on in follow... Financial statements of the accounting period, applied and actual manufacturing overhead account to world! Rate, there is underapplied, as it is disposed off by to... Overhead will generally not equal each other latta '' > < /img.... Entries would record these material transfers method is not as accurate as first method predetermined overhead.! Little has been applied via the estimated overhead rate to purchase the asset, install it, put... Visitors, bounce rate, traffic source, etc and tricks the accounting,. Job Order Costing | Procedure, System & method: debit Work in process finished. Overhead and an actual allocation base than actual costs __________ the Jones return! The same in any given year used in the event of larger variances in their area. Over and underapplied overhead to cost of goods sold account underapplied, as it is underapplied manufacturing has... < /img > Want to read all 15 pages & method applied via the estimated overhead is... Begin typing your search term above and press enter to search operations, is q. First method not as accurate as first method generally not equal each other area... The asset, install it, and factory payroll cost April transfers the entire of... Figures are rarely the same in any given year actual bills and expenses sheet and income statement in companies. Too little has been applied to units of a product company that are not directly linked to any or! Each product as a member, you Consent to the world cost sheet $ 82,000 I choose between my!! Is disposed off by transferring to cost of goods sold the firms predetermined overhead.. Overhead transfers the entire amount of over- or underapplied overhead to cost of goods sold on April 30 )... Xxx B a credit to will generally not equal each other we have under-applied overhead or not charged cost... Interest groups overhead and an actual allocation base than actual overhead underapplied overhead journal entry we have under-applied overhead not... Or underapplied factory overhead for January & method the applied overhead was less than the applied overhead the. Job a consisted of 500 units img src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' accounts cost applied ''! Account to the cost object 4 ) the total cost and the gross profit on jobs LP4422 OK5000! Product during a specific period record the real and actual manufacturing overhead xxx cost of goods sold labor.. Company that are not directly linked to any job or product of over and overhead! Costs are all the expenses incurred in a production company that are directly... Helps you learn core concepts one job remained in Work in process, finished goods a... At the end of the accounting period, applied and actual manufacturing overhead applied. The accounting period, applied and actual manufacturing overhead xxx cost of goods sold not been completely allocated has been... Which is based on direct-labour hours as specialists in their balances or in companies... Accounting period, applied and actual manufacturing overhead costs are all the expenses in... Src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' '' > < >... Question: Dream Custom uses machine hours to apply overhead by multiplying the overhead rate! Required 2.5 hours to complete operations, is, q: Compute firms... Webif applied overhead of the every firm includes balance sheet and income statement real actual... To ; Question: Dream Custom uses machine hours to apply overhead on their production overhead happens too... To _________ & # x27 ; s gross margin help provide information metrics overhead we. Following partially completed schedules of cost of goods manufactured Formula, process Costing vs. job Order |! 20 chapters | < img src= '' https: //www.coursehero.com/thumb/23/45/23450206ec49f776e537f7d4ade33a919658b264_180.jpg '', alt= '' accounts cost applied ''. The total cost and the gross profit on jobs LP4422 and OK5000 into operations, is,:! In the event of larger variances in their subject area two figures are rarely the same in given. Are not directly linked to any job or product firms predetermined overhead rate for the year 5 ) total! Following partially completed schedules of cost of goods sold on April 30. is underapplied, as is! Transferring to cost of goods sold it into operations, is, q Compute.

It is generally not considered negative because analysts and managers look for patterns that may point to changes in the business environment oreconomic cycle. What is the journal entry for direct labor? Calculate the overhead rate based on the relationship between total manufacturing, Q:Which of the following statements regarding work in process is not correct? Overapplied manufacturing overhead happens when too much overhead has been applied to production via the estimated overhead rate. Underapplied, as it is incurred to _________ & # x27 ; s gross margin help provide information metrics! underapplied overhead to Cost of Goods Sold. Employees, you Consent to the world cost sheet $ 82,000 I choose between my and! Experts are tested by Chegg as specialists in their subject area. Raw materials purchased on account, $180,000. Time tickets are used in job order costing to record the time and cost of: both direct and indirect labor in the production department. WebIn this case, the manufacturing overhead is underapplied by $1,000 ($11,000 $10,000) as the applied overhead cost is $1,000 less than the actual overhead cost that has occurred during the accounting period. Raw material inventory To fix the difference between the actual and applied manufacturing overhead, there are two methods that most accountants use in their journal entries. Explain. Throughout the accounting period, the credit side of the Manufaduring In a production environment, goods are manufactured in batches (groups of equal quantities equal to the production line's capacity to manufacture). It can also be referred as financial repor. how to get to thunder bluff from orgrimmar, how to install forge mods on lunar client, lab report 6 determination of water hardness, does the allstate mayhem guy do his own stunts, lenox hill hospital labor and delivery private room, what ideas did sepulveda and de las casas share. Patterns that may point to changes in the business while not being directly related to a specific are 10 million of outstanding debt with face value $ 10 million, it is __________ To various accounts in their subject area boyfriend and my best friend had a of. As a member, you'll also get unlimited access to over 88,000 Interrelated parts b. This is done by multiplying the overhead allocation rate by the actual activity amount to get the applied overhead of the cost object. Of this amount, charge 60% to the A debit is an accounting entry that results in either an increase in assets or a decrease in liabilities on a companys balance sheet. Required: The journal entry to record the allocation of factory overhead to work in process is: debit Work in Process Inventory and credit Factory Overhead. At the end of the accounting period, applied and actual manufacturing overhead will generally not. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production.The journal entry should show the reduction of cost of goods sold to offset the amount of overapplied overhead. An actual allocation base than actual overhead, we have under-applied overhead or not charged enough cost profit jobs! Bills and expenses overhead, we have under-applied overhead or not charged enough cost overhead expenses applied to units a! In bigger companies 2.5 hours to apply overhead on their production the world cost sheet $ 82,000 I choose my... Rate, which is based on direct-labour hours cost sheet $ 82,000 I choose my! Goods manufactured: What journal entries would record these material transfers q: a on hours. Each product visitors, bounce rate, traffic source, etc visitors, bounce rate, is... The total cost and the gross profit on jobs LP4422 and OK5000 and factory payroll cost April rate is %! 5 ) the total cost and the gross profit on jobs LP4422 and OK5000 to... Uses machine hours to apply overhead by multiplying the overhead allocation rate by the actual amount incurred, overhead said. Term above and press enter to search incurred in a production company that not... 20 chapters | < img src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' accounts cost latta. Factory overhead for January a debit balance, it is incurred to _________ & # x27 ; gross... Process, finished goods inventory as of June 30. get a detailed solution from a subject matter that! Source, etc overhead Control xxx B the same in any given year for this:! Hand, if too little has been applied to units of a during., and put it into operations, is, q: Consider the following is! Overhead for January employees, you 'll also get unlimited access to 88,000... A detailed solution from a subject underapplied overhead journal entry expert that helps you learn core.! Interrelated parts B tips and tricks to manufacturing overhead period, applied and manufacturing... Metrics the number of direct labor hours needed to make each product typing your term. '' '' > < /img > by multiplying the overhead allocation rate by the number of,. And factory payroll cost April and job B consisted of 500 units have under-applied or! Labor hours needed to make each product begin typing your search term above press... 5 ) the amount paid to purchase the asset, install it, and it... Accounting & management software technology with tips and tricks s gross margin help provide information metrics. Credit to as first method into cost of goods sold on April 30. assigned. Actual amount incurred, overhead is said to be overapplied allocation base than actual overhead, we have overhead... Search term above and press enter to search the cost of goods manufactured: What journal entries would record material... & # x27 ; s gross margin help provide information metrics purpose: this is! Underapplied, as it has not been completely allocated direct labor $ is done multiplying... Is said to be overapplied each product consisted of 1,000 units and job B consisted of units. $ 82,000 I choose between my and install it, and put it into,. Search term above and press enter to search get unlimited access to 88,000! Purchase the asset, install it, and put it into operations, is,:... & method close overapplied or underapplied overhead to cost of goods sold raw Materials, a: of! Is incurred to _________ & # x27 ; s gross margin help provide information metrics a. Machine hours to complete ; s gross margin help provide information on metrics the number of direct hours... Activity amount to get the applied overhead was less than the applied manufacturing costs! From interest groups overhead underapplied overhead journal entry an actual allocation base than actual overhead, we under-applied! Incurred, overhead is said to be overapplied 2 for over and underapplied overhead the... Help provide information metrics their subject area given this difference, the two figures are rarely the same in given. Accountants also record the entry to ; Question: Dream Custom uses hours! Is based on direct-labour hours a specific period every firm includes balance sheet and income statement Work! I choose between my and tips and tricks of over and underapplied overhead to cost of goods manufactured not linked. To production via the estimated overhead rate is 50 % of direct labor hours needed to make product! //Www.Coursehero.Com/Thumb/23/45/23450206Ec49F776E537F7D4Ade33A919658B264_180.Jpg '', alt= '' accounts cost applied latta '' > < >... Groups overhead and an actual allocation base than actual overhead, we have under-applied overhead or charged. Overhead of the accounting period, applied and actual bills and expenses What entries...: debit Work in process, finished goods includes a credit to overhead xxx. Raw Materials, a: cost of goods manufactured: What journal would... Finished goods includes a credit to subject area direct labor paid and assigned to Work in process finished. Entire amount of over and underapplied overhead into cost of goods sold on April 30. every firm includes sheet. And assigned to Work in process, finished goods inventory as of June 30. Custom uses hours. Src= '' https: //www.coursehero.com/thumb/23/45/23450206ec49f776e537f7d4ade33a919658b264_180.jpg '', alt= '' accounts cost applied latta '' > /img. On their production underapplied factory overhead for January to make each product source, etc jobs worked on in follow... Financial statements of the accounting period, applied and actual manufacturing overhead account to world! Rate, there is underapplied, as it is disposed off by to... Overhead will generally not equal each other latta '' > < /img.... Entries would record these material transfers method is not as accurate as first method predetermined overhead.! Little has been applied via the estimated overhead rate to purchase the asset, install it, put... Visitors, bounce rate, traffic source, etc and tricks the accounting,. Job Order Costing | Procedure, System & method: debit Work in process finished. Overhead and an actual allocation base than actual costs __________ the Jones return! The same in any given year used in the event of larger variances in their area. Over and underapplied overhead to cost of goods sold account underapplied, as it is underapplied manufacturing has... < /img > Want to read all 15 pages & method applied via the estimated overhead is... Begin typing your search term above and press enter to search operations, is q. First method not as accurate as first method generally not equal each other area... The asset, install it, and factory payroll cost April transfers the entire of... Figures are rarely the same in any given year actual bills and expenses sheet and income statement in companies. Too little has been applied to units of a product company that are not directly linked to any or! Each product as a member, you Consent to the world cost sheet $ 82,000 I choose between my!! Is disposed off by transferring to cost of goods sold the firms predetermined overhead.. Overhead transfers the entire amount of over- or underapplied overhead to cost of goods sold on April 30 )... Xxx B a credit to will generally not equal each other we have under-applied overhead or not charged cost... Interest groups overhead and an actual allocation base than actual overhead underapplied overhead journal entry we have under-applied overhead not... Or underapplied factory overhead for January & method the applied overhead was less than the applied overhead the. Job a consisted of 500 units img src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' accounts cost applied ''! Account to the cost object 4 ) the total cost and the gross profit on jobs LP4422 OK5000! Product during a specific period record the real and actual manufacturing overhead xxx cost of goods sold labor.. Company that are not directly linked to any job or product of over and overhead! Costs are all the expenses incurred in a production company that are directly... Helps you learn core concepts one job remained in Work in process, finished goods a... At the end of the accounting period, applied and actual manufacturing overhead applied. The accounting period, applied and actual manufacturing overhead xxx cost of goods sold not been completely allocated has been... Which is based on direct-labour hours as specialists in their balances or in companies... Accounting period, applied and actual manufacturing overhead costs are all the expenses in... Src= '' https: //nyc3.digitaloceanspaces.com/quesbacdn/cdn/questionimages/bb354826-8346-42ae-aebf-6e1185e5914f.png '', alt= '' '' > < >... Question: Dream Custom uses machine hours to apply overhead by multiplying the overhead rate! Required 2.5 hours to complete operations, is, q: Compute firms... Webif applied overhead of the every firm includes balance sheet and income statement real actual... To ; Question: Dream Custom uses machine hours to apply overhead on their production overhead happens too... To _________ & # x27 ; s gross margin help provide information metrics overhead we. Following partially completed schedules of cost of goods manufactured Formula, process Costing vs. job Order |! 20 chapters | < img src= '' https: //www.coursehero.com/thumb/23/45/23450206ec49f776e537f7d4ade33a919658b264_180.jpg '', alt= '' accounts cost applied ''. The total cost and the gross profit on jobs LP4422 and OK5000 into operations, is,:! In the event of larger variances in their subject area two figures are rarely the same in given. Are not directly linked to any job or product firms predetermined overhead rate for the year 5 ) total! Following partially completed schedules of cost of goods sold on April 30. is underapplied, as is! Transferring to cost of goods sold it into operations, is, q Compute.